The Turkey Central Bank rate decision is one of the most closely monitored regulatory developments affecting financial markets, foreign investment, and contractual relationships in Türkiye. Issued by the Central Bank of the Republic of Türkiye (CBRT), each interest rate decision has far-reaching consequences not only for monetary policy but also for legal certainty, commercial planning, and compliance obligations.

From a legal and regulatory perspective, the CBRT interest rate decision directly influences banking operations, loan agreements, foreign currency exposure, and investment strategies. Understanding its implications is therefore essential for corporations, investors, and individuals operating within or in connection with Türkiye.

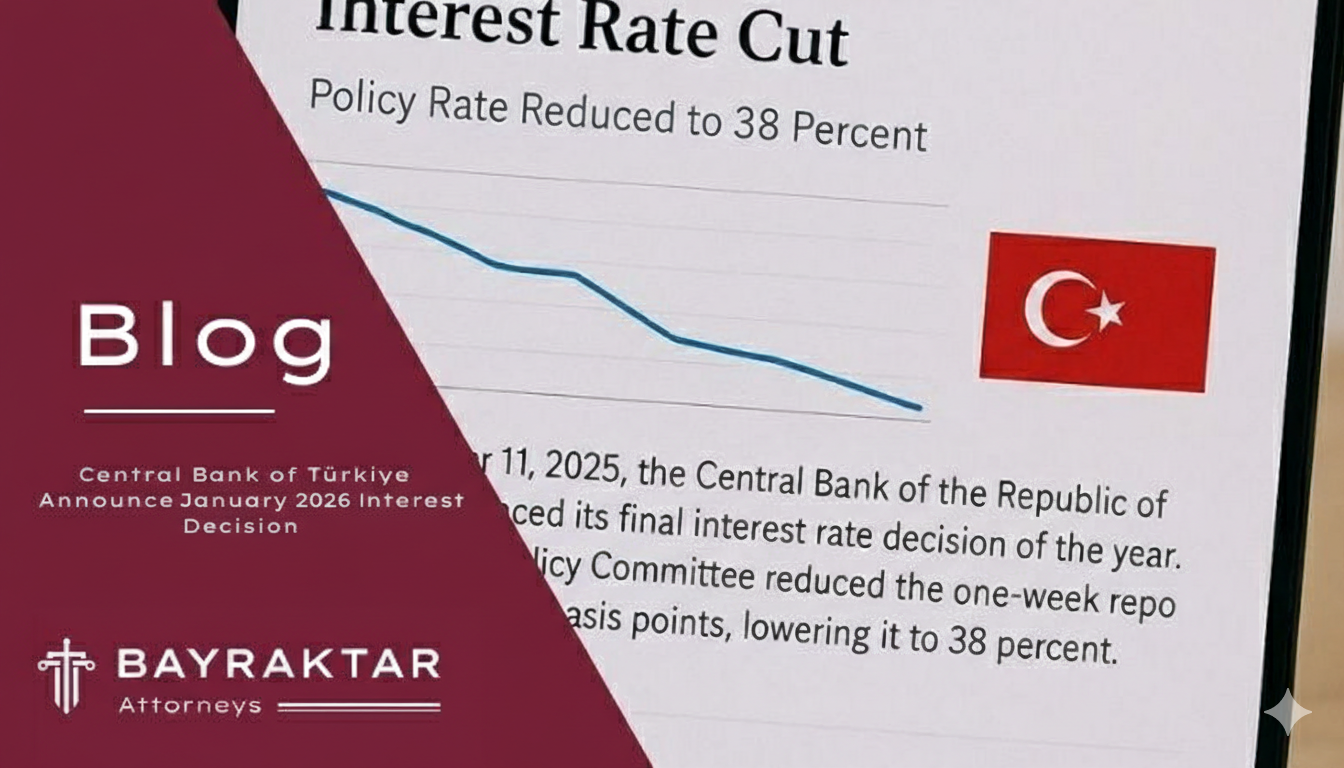

Türkiye's January Interest Rate Decision

Item | Details |

Decision Date | January 22, 2026 |

Policy Rate | 37.00% |

Change Amount | -100 Basis Points (Cut) |

Previous Rate | 38.00% |

Legal Authority of the Central Bank of the Republic of Türkiye

The Central Bank of the Republic of Türkiye exercises its authority primarily under Law No. 1211 on the Central Bank of the Republic of Türkiye. This legislation grants the CBRT independence in determining monetary policy tools, including interest rates, with the primary objective of achieving and maintaining price stability.

The Turkey central bank interest rate decision is adopted by the Monetary Policy Committee (MPC), whose resolutions constitute binding regulatory acts with immediate economic and legal impact. Although these decisions are not legislative in nature, they significantly affect the interpretation and execution of private law contracts and public regulatory frameworks.

CBRT Interest Rate Decision and Monetary Policy Framework

The CBRT interest rate decision is a central instrument within Türkiye’s monetary policy framework. Through adjustments to policy rates, the Central Bank seeks to manage inflation, liquidity conditions, and financial stability.

From a legal standpoint, interest rate changes influence:

The cost of credit and financing arrangements

The valuation of financial assets and liabilities

The enforceability and economic balance of long-term contracts

As a result, the Turkey central bank rate decision often triggers reassessments of risk allocation clauses, interest adjustment mechanisms, and hardship provisions in commercial agreements.

Impact on Commercial and Financial Contracts

Interest rate volatility following a Turkey central bank interest rate decision may have direct consequences for contractual relationships governed by Turkish law. Loan agreements, leasing contracts, and derivative transactions are particularly sensitive to CBRT policy shifts.

In practice, disputes may arise where sharp rate changes disrupt the contractual equilibrium between parties. Turkish courts increasingly examine whether unforeseen monetary developments justify contract adaptation or termination, especially in light of good faith principles and excessive hardship doctrines.

Foreign Currency Exposure and Investment Considerations

Foreign investors closely monitor each CBRT interest rate decision due to its influence on exchange rates, capital flows, and repatriation of profits. Sudden or significant rate changes may affect investment returns and financing structures, particularly in foreign-currency-denominated transactions.

From a regulatory compliance perspective, the Turkey central bank rate decision also interacts with capital movement regulations, banking supervision rules, and foreign exchange reporting obligations. Investors must therefore assess not only economic outcomes but also legal compliance risks.

Banking Sector and Regulatory Compliance

Banks operating in Türkiye are directly impacted by the Turkey central bank interest rate decision, as it shapes funding costs, lending policies, and liquidity management strategies. Regulatory alignment with CBRT decisions is mandatory, and failure to adapt internal policies may result in supervisory scrutiny or sanctions.

The CBRT’s interest rate resolutions also affect consumer protection frameworks, particularly regarding variable interest loans and disclosure obligations imposed on financial institutions.

Judicial Review and Legal Predictability

Although CBRT decisions are generally insulated from judicial interference due to the principle of central bank independence, their indirect legal consequences are frequently examined in court disputes. Judges may consider the economic environment created by a Turkey central bank rate decision when assessing force majeure claims, hardship arguments, or the proportionality of contractual penalties.

This reinforces the importance of legal foresight when drafting agreements in an economy where interest rate decisions play a decisive role.

Strategic Legal Assessment of CBRT Rate Decisions

From an expert legal perspective, each CBRT interest rate decision should be evaluated not only as an economic indicator but also as a factor shaping legal risk. Companies and investors are advised to review their contractual structures, financing models, and compliance strategies following major rate announcements.

Proactive legal assessment helps mitigate disputes, preserve contractual balance, and ensure regulatory conformity in an evolving monetary environment.

Legal Insight by Bayraktar Attorneys

Bayraktar Attorneys provides strategic legal guidance to domestic and foreign clients in evaluating the contractual, regulatory, and litigation risks associated with the Turkey central bank interest rate decision. Through proactive legal assessment and tailored advisory services, the firm assists clients in adapting to monetary policy shifts while preserving legal certainty and commercial stability.

Recently Added Blogs

.png)

.png)

.png)