Demystifying Taxation for Companies in Turkey

At Bayraktar Attorneys, we are dedicated to helping businesses navigate the intricate world of taxation in Turkey. Understanding the tax obligations is not only crucial for compliance but also vital for making informed financial decisions.

In this comprehensive blog, we will delve into the key taxes that companies operating on the Turkish mainland need to be aware of and explore how they can efficiently manage these tax liabilities.

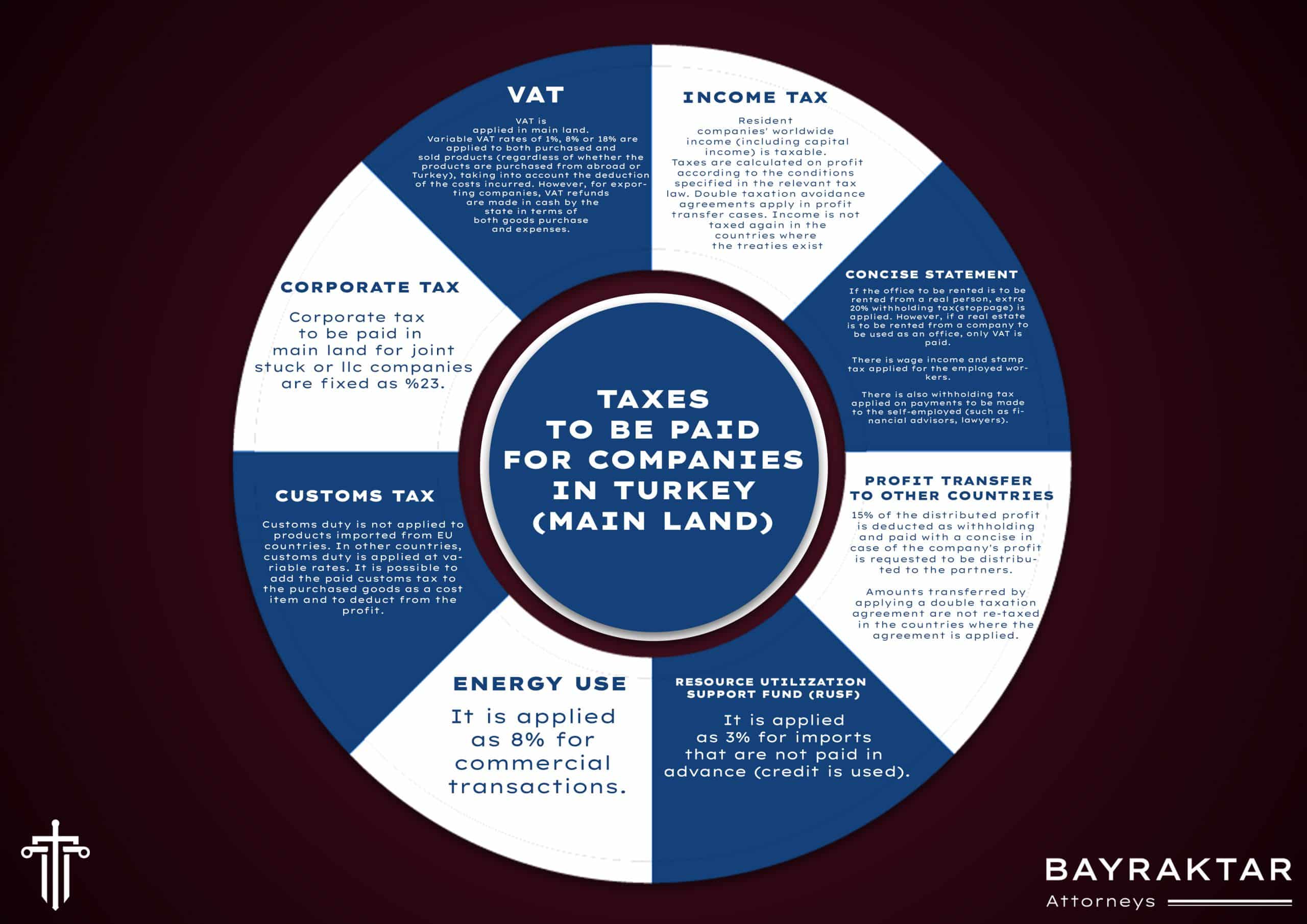

- Corporate Tax: Corporate tax is a fundamental aspect of the Turkish tax system for joint-stock or limited liability companies. The standard corporate tax rate stands at 23% on the company’s taxable income. Accurate calculation and reporting of taxable income are essential to fulfill obligations to the tax authorities.

- Value Added Tax (VAT): Value Added Tax (VAT) plays a pivotal role in Turkey’s tax revenue generation. VAT is levied on both purchased and sold products and services. As of recent changes, the standard VAT rate has been set at 20%, applicable to a wide range of goods and services. Careful management of VAT obligations is crucial for businesses to avoid penalties and maintain a competitive edge.

- Income Tax: Resident companies in Turkey are subject to worldwide income taxation, including capital income. Taxes are calculated based on the company’s profits, considering the provisions specified in the relevant tax laws. Double taxation avoidance agreements with various countries prevent income from being taxed again in those nations.

- Office Rental Taxation: Office rental taxation comes into play when companies establish a physical presence in Turkey. Renting an office space from an individual attracts an additional 20% withholding tax (stoppage). Conversely, if the office space is rented from a company, only VAT is levied on the rental amount.

- Wage Income and Stamp Tax: Wage income tax applies to employed workers in Turkey, with rates varying based on income levels. Additionally, companies are responsible for paying the corresponding stamp tax on employee wages. Employers must diligently withhold the correct amount of tax from their employees’ salaries and remit it promptly to the tax authorities.

- Withholding Tax for Self-Employed Individuals: Certain professionals operating as self-employed individuals, such as financial advisors and lawyers, are subject to withholding tax on their payments. Companies must accurately calculate and remit the required withholding tax to remain compliant.

- Customs Tax: Customs duties are an integral part of the tax landscape for companies importing goods into Turkey. While products imported from EU countries generally enjoy exemptions, imports from other countries are subject to customs duties at variable rates. Factoring in these customs taxes as cost items during imports ensures a clear financial picture.

- Energy Use Tax: Commercial transactions involving energy consumption attract an 8% tax rate. Businesses must include this tax in their financial planning to manage costs effectively.

- Resource Utilization Support Fund (RUSF): Imported goods that involve the use of credit and are not paid in advance attract a 3% Resource Utilization Support Fund (RUSF). Considering this additional cost is essential for accurate financial planning.

- Profit Transfer to Other Countries: When companies distribute profits to their partners, 15% of the distributed profit is withheld as a tax. However, profits transferred under double taxation agreements are exempt from being taxed again in the countries where these agreements apply.

Navigating the tax landscape in Turkey requires expert guidance. Bayraktar Attorneys is here to provide you with the knowledge and assistance you need to ensure compliance, mitigate risks, and optimize your financial strategies. For further legal assistance or inquiries, please feel free to contact us.

Stay tuned for our next blog, where we will explore the unique tax regulations for companies operating in Free Trade Zones in Turkey.

Recently Added Blogs

.png)

.png)

.png)

.png)